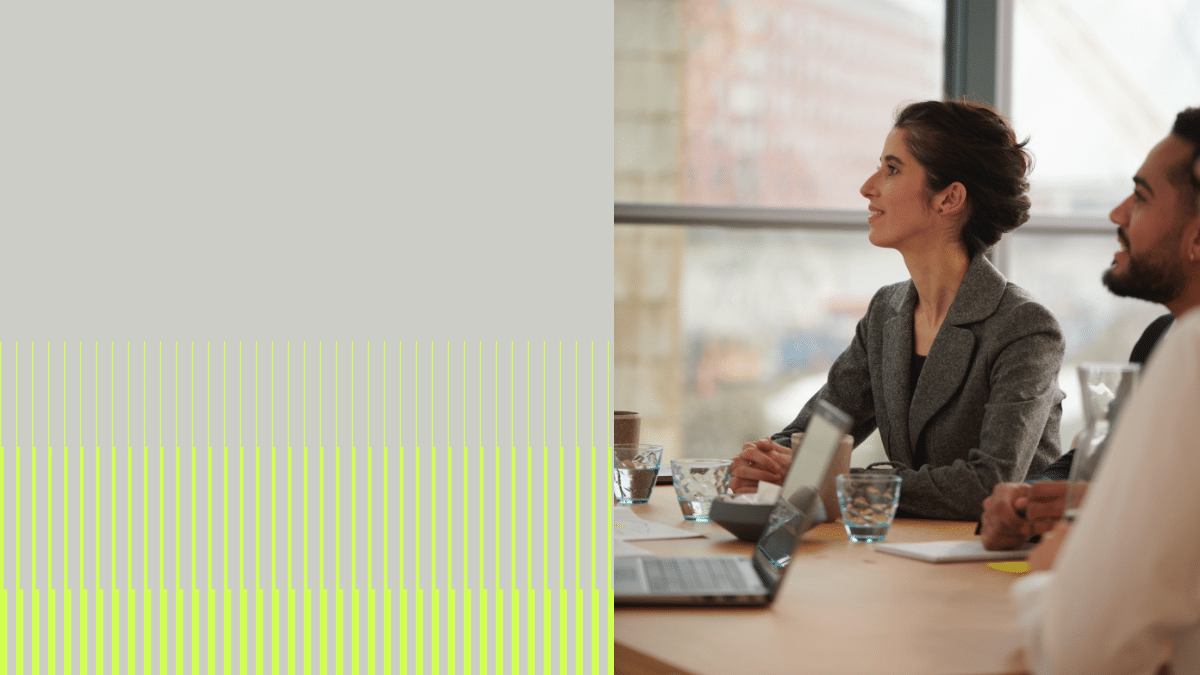

Improved Customer Service

One of the most significant benefits of AI in the banking industry is the ability to provide personalised and efficient customer service. AI-powered chatbots can help banks provide 24/7 support to their customers, helping them with queries and concerns in real-time. This means that customers can get their problems solved efficiently without having to wait for a human representative.

In the current climate, customers demand faster responses and AI can be the solution businesses need to enhance efficiency and retain loyalty.

AI-powered customer service can also reduce costs in an organisation as it replaces human representatives, enabling long-term sustainability of a business.

Despite the prospects AI has already had in improving customer service, organisations must be aware of potential challenges - safeguarding the security and privacy of customer data is crucial and not to be dismissed.

Fraud Detection and Prevention

Banks are often susceptible to fraud, and it remains a complex issue to tackle within the industry. AI is becoming an invaluable tool in detecting and preventing fraud by analysing large volumes of data to identify patterns and anomalies.

Machine learning algorithms can learn from past data and detect any suspicious activities, such as unusual spending patterns or transactions that are out of the ordinary. By identifying fraudulent activity quickly, banks can minimise losses and protect their customers' accounts, thereby protecting their reputation.

Implementing AI into an organisation's fraud prevention strategy can also help banks remain compliant with data governance regulations.